The cost of setting up a Power of Attorney (PoA) in the UK varies depending on the type of PoA, additional services such as legal assistance, and whether you qualify for exemptions or reductions. This guide outlines the costs involved in creating a PoA, registration fees, optional solicitor fees, and situations where cost reductions may apply.

1. Types of Power of Attorney and Associated Costs

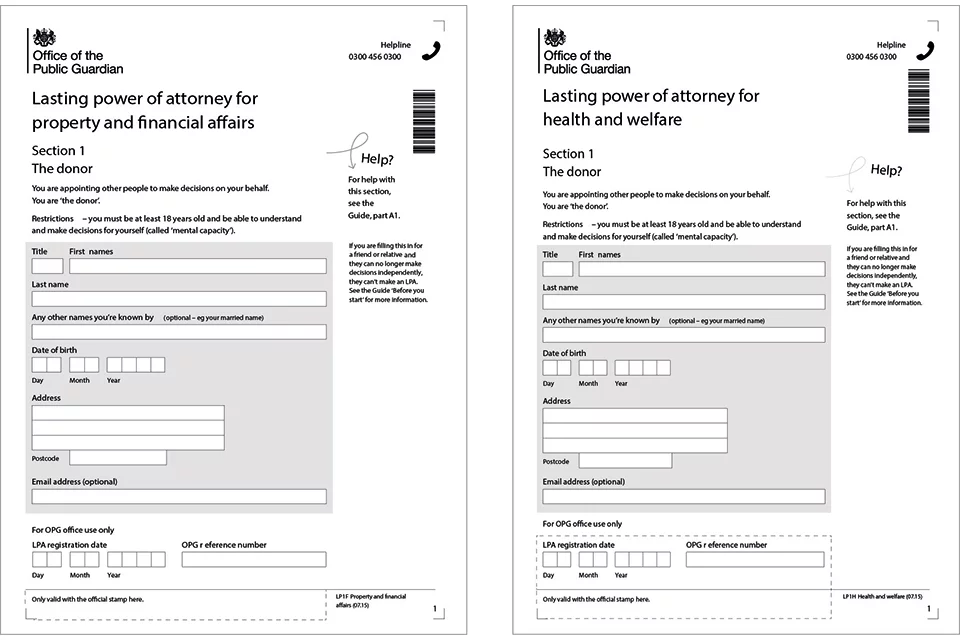

The cost of a Power of Attorney in the UK depends on the type of PoA you choose. The two main types are Lasting Power of Attorney (LPA) and General Power of Attorney.

- Lasting Power of Attorney (LPA):

- An LPA must be registered with the Office of the Public Guardian (OPG) before it can be used.

- The LPA has two categories:

- Health and Welfare LPA

- Property and Financial Affairs LPA

- The cost to register each LPA is £82. If you create both types, the combined registration fee is £164.

- General Power of Attorney:

- This type of PoA is often used for specific or temporary arrangements. It doesn’t require registration with the OPG and is usually cheaper.

- The cost to create a General PoA depends on whether you draft it yourself or involve a solicitor. Legal fees may range from £50 to £300, depending on the complexity.

- Enduring Power of Attorney (EPA):

- EPAs are only valid if they were created before October 1, 2007. Registration is required if the donor loses mental capacity.

- The registration fee for an EPA is also £82.

2. Exemptions and Reductions in Fees

The Office of the Public Guardian provides financial relief to individuals who may not be able to afford the standard registration fees. You might qualify for a fee reduction or exemption based on your financial circumstances.

- Fee Reduction:

- If your income before tax is less than £12,000 per year, you may be eligible for a 50% reduction in the registration fee.

- For an LPA, this means paying £41 instead of £82.

- Fee Exemption:

- If you receive certain means-tested benefits (e.g., Income Support, Universal Credit, Housing Benefit), you might not need to pay any registration fees.

- Evidence of the benefits you receive must be provided when applying for the exemption.

3. Costs for Solicitor Services

While it’s possible to create a Power of Attorney without legal assistance, many people choose to hire a solicitor to ensure that the document is correctly drafted and all legal requirements are met. The cost of hiring a solicitor can vary widely based on their expertise and location.

- Average Solicitor Fees:

- Drafting a single LPA typically costs between £200 and £500.

- Creating both a Health and Welfare LPA and a Property and Financial Affairs LPA may cost between £400 and £800.

- Additional Costs:

- Some solicitors charge extra for services like witnessing the document, providing advice, or acting as a certificate provider (a person who verifies the donor understands the PoA).

4. DIY Power of Attorney Costs

For individuals who prefer to create their PoA without professional help, the cost is significantly lower.

- Online Forms:

- You can complete the Power of Attorney forms online for free by visiting the OPG’s official website. However, you will still need to pay the registration fee of £82 per LPA.

- Potential Risks of DIY Approach:

- Errors in completing the forms can result in delays or rejections, which may incur additional costs if corrections are needed.

5. Additional Costs to Consider

When creating a Power of Attorney, there are some optional but important costs to consider:

- Certified Copies:

- Many organizations, such as banks, may require certified copies of your Power of Attorney document.

- Each certified copy typically costs between £10 and £50, depending on who provides the certification (solicitor or notary).

- Amendments:

- If you need to make changes to your PoA after it’s been created, additional legal fees may apply. Changes to an LPA require a new registration, costing another £82.

- Revoking a Power of Attorney:

- While there is no direct fee for revoking a PoA, you may incur legal fees if you involve a solicitor in the process.

- Disputes and Challenges:

- If disputes arise regarding the Attorney’s actions, legal advice or court intervention may be necessary. These costs can range from a few hundred to several thousand pounds.

6. How to Save on Power of Attorney Costs

- Use Official Online Forms:

- Completing the official OPG forms yourself can save you solicitor fees. Ensure that you follow the guidance carefully to avoid errors.

- Shop Around for Solicitors:

- If you choose to use a solicitor, compare quotes from different firms to find the best deal.

- Apply for Fee Exemptions:

- Check whether you qualify for a fee reduction or exemption based on your financial situation or benefits received.

7. Why Invest in a Power of Attorney?

While the costs associated with creating a Power of Attorney may seem significant, it is a valuable investment in ensuring that your financial, health, and personal matters are managed according to your wishes. A properly created PoA can prevent legal complications, reduce stress for your loved ones, and provide peace of mind.

By understanding the various costs involved in creating and registering a Power of Attorney in the UK, you can make informed decisions that suit your needs and budget. Whether you opt for a DIY approach or professional legal assistance, a Power of Attorney is an essential tool for planning for the future.