When looking for a home loan in Australia, the interest rate is one of the most important factors to consider. The interest rate affects the amount you pay each month and the overall cost of the loan throughout its life. Understanding how interest rates work, the types of rates available, and how to secure the best deal is crucial for anyone thinking of buying a home.

In this guide, we’ll explore the key aspects of home loan interest rates in Australia, including what they are, the different types available, and tips for securing a competitive rate.

What is a Home Loan Interest Rate?

A home loan interest rate is the percentage of the loan amount that the lender charges as interest for borrowing money. It is calculated on the outstanding balance of your loan and added to your repayments. The higher the interest rate, the higher the amount you will pay over the term of the loan.

Factors That Affect Home Loan Interest Rates

Several factors influence the interest rate on home loans in Australia:

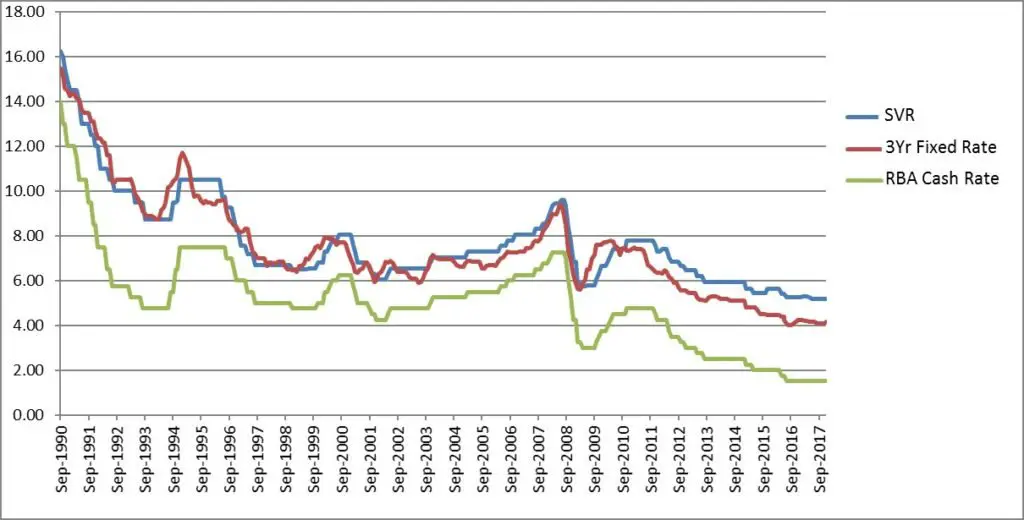

- Reserve Bank of Australia (RBA) Cash Rate: The cash rate set by the RBA is one of the most significant influences on home loan interest rates. When the RBA raises or lowers the cash rate, banks and lenders usually follow suit by adjusting their interest rates accordingly.

- Economic Conditions: Economic factors such as inflation, economic growth, and market stability can affect home loan interest rates. A stronger economy may lead to higher rates, while an economic downturn could result in lower rates.

- Lender’s Cost of Borrowing: Lenders often adjust their interest rates based on their own borrowing costs. If the cost of funding for a lender rises (e.g., through international borrowing), the lender may pass these costs on to consumers in the form of higher rates.

- Loan-to-Value Ratio (LVR): The size of your deposit compared to the price of the property you are purchasing plays a role in the interest rate you are offered. A higher LVR (i.e., a smaller deposit) may result in a higher interest rate to offset the lender’s risk.

- Credit Score: Your credit history and credit score also impact the interest rate. A higher credit score indicates to the lender that you are a lower risk borrower, which can result in a more favorable rate.

Types of Home Loan Interest Rates

In Australia, home loans typically come with one of the following interest rate structures:

1. Fixed-Rate Home Loans

A fixed-rate home loan means that the interest rate stays the same for a set period, usually between 1 to 5 years. The advantage of this option is that your repayments will remain stable and predictable during the fixed term. This is ideal for people who want to budget with certainty.

Pros:

- Predictable repayments.

- Protection from interest rate increases during the fixed period.

Cons:

- Limited flexibility in making additional repayments (may be capped).

- Higher interest rates compared to variable loans in some cases.

2. Variable-Rate Home Loans

With a variable-rate home loan, the interest rate can fluctuate over the life of the loan. This means your repayments could go up or down depending on changes to the lender’s interest rate or the RBA cash rate.

Pros:

- Potential for lower rates, especially if the RBA reduces the cash rate.

- More flexibility, including options to make extra repayments and access offset accounts or redraw facilities.

Cons:

- Uncertainty in repayment amounts.

- Interest rates may rise, resulting in higher repayments.

3. Split-Rate Home Loans

A split-rate home loan is a combination of both fixed and variable-rate loans. You can choose to have a portion of your loan with a fixed rate and the other portion with a variable rate. This provides the stability of fixed repayments while still allowing for flexibility with part of your loan.

Pros:

- Balance of stability and flexibility.

- Potential for lower repayments if the variable part of the loan decreases in rate.

Cons:

- The fixed part can be inflexible with limits on extra repayments.

- Not all lenders offer this type of loan, and it may come with additional fees.

4. Interest-Only Loans

An interest-only loan allows you to pay only the interest for a certain period (usually between 1 to 5 years). This means that you don’t reduce the principal balance of the loan during the interest-only period. While this can result in lower initial repayments, your overall debt doesn’t decrease during this time.

Pros:

- Lower initial repayments.

- Can free up cash for other financial goals in the short term.

Cons:

- No reduction in the principal loan amount during the interest-only period.

- After the interest-only period ends, repayments may significantly increase.

5. Low Doc Loans

Low documentation (low-doc) loans are typically offered to self-employed individuals or borrowers who may not have traditional documentation such as tax returns or payslips. These loans often come with higher interest rates due to the increased risk to lenders.

Pros:

- More accessible for self-employed borrowers or those with non-standard income.

- Fewer documentation requirements.

Cons:

- Higher interest rates than standard loans.

- Lender may require a larger deposit.

How to Get the Best Home Loan Interest Rate

Securing a competitive interest rate can save you thousands of dollars over the life of your loan. Here are some strategies to help you get the best deal:

1. Shop Around and Compare Lenders

It’s essential to compare different lenders, including major banks, smaller banks, credit unions, and non-bank lenders. Interest rates can vary significantly, so it’s worth taking the time to explore your options. Online comparison websites make it easy to view a range of offers side by side.

2. Consider Your Loan Term

Home loans in Australia typically come with terms ranging from 25 to 30 years. While a longer-term loan may lower your monthly repayments, it can also increase the total amount you pay in interest. Shorter-term loans may offer lower interest rates, but they come with higher monthly repayments.

3. Maintain a Strong Credit Score

A good credit score (700 or above) can help you secure a better interest rate. Lenders view borrowers with high credit scores as less risky, which can lead to more favorable terms. If your credit score is low, work on improving it before applying for a loan.

4. Save a Larger Deposit

The larger your deposit, the lower your loan-to-value ratio (LVR), which can lead to a lower interest rate. Aim for a deposit of at least 20% of the property’s value to avoid Lenders Mortgage Insurance (LMI) and secure a better rate.

5. Consider Using a Mortgage Broker

A mortgage broker can help you navigate the home loan process and find the best interest rate based on your financial situation. Brokers have access to a wide range of lenders and loan products, and they can often negotiate better terms for you.

The Impact of Interest Rates on Your Loan

Interest rates have a significant impact on your home loan repayments and the total cost of the loan. For example, if you borrow $500,000 over 30 years with an interest rate of 4% (variable), your monthly repayments would be around $2,387. However, if the interest rate increases to 5%, your repayments would rise to around $2,684 per month.

Over the life of the loan, this increase in the interest rate can add tens of thousands of dollars to the total repayment amount. Therefore, securing a lower interest rate can make a substantial difference to your overall financial situation.